Flowscalper

Discover How To Trade Order Flow

Without Having To Read And Decipher The Order Flow.

Without Having To Read And Decipher The Order Flow.

Orderflows.com Presents The Flowscalper Add-On For NinjaTrader 8

Finally Make Sense Out Of The Order Flow!

My name is Michael Valtos and I spent 20 years as an institutional trader at JP Morgan, Cargill, Commerzbank, EDF Man and Dean Witter Reynolds. The one thing that I have found to be single most important part of market analysis is order flow because it gets you as close to the market as possible.

What the market is doing right now affects what will happen next.

Order flow is the missing link for many traders because it allows them to understand what is really happening in the market. Analyzing order flow lets a trader know how trade is being facilitated in any direction.

What the market is doing right now affects what will happen next.

Order flow is the missing link for many traders because it allows them to understand what is really happening in the market. Analyzing order flow lets a trader know how trade is being facilitated in any direction.

Market movements are not the results of prices moving randomly; rather, it is the collective activity of market participants. Order flow now has ways to organize the market generated data of delta, point of control, imbalances and volume into visual structure that allows a trader to see when there is market strength, market weakness, aggressiveness, distribution, accumulation and absorption.

Order flow scalping is the art of determining the immediate trend of prices. The immediate trend can start at any moment. A trader needs to be able to recognize when it happens so that he can capitalize on it for maximum returns from a good trade entry.

Order flow scalping is the art of determining the immediate trend of prices. The immediate trend can start at any moment. A trader needs to be able to recognize when it happens so that he can capitalize on it for maximum returns from a good trade entry.

A good trader knows what most traders don't...that occurs right in front of them is going to have the most impact on market direction.

If You Want To Add The Power Of Order Flow Analysis To Your Trading,

Then You NEED To Get The Flowscalper Today!

Then You NEED To Get The Flowscalper Today!

Introducing the Orderflows Flowscalper - A powerful tool that analyzes the order flow generated data of delta, point of control, imbalances and volume to show you when the order flow is bullish or bearish.

Markets and order flow are dynamic. It is constantly moving, but out of this seemingly disorder, order arises. When it does it can be clearly seen and acted upon. Remember, markets exist to facilitate trade between parties, in other words transfer risk from producers to users. There are times when one side wants to "facilitate" trade more than others. Basically, they need to transfer as much risk away from them as possible. There can be many reasons why traders buy or sell to transfer risk. The key is to see when it happens, because when this happens, it happens quickly and when it, does it stands out in the order flow. The Flowscalper was created to show you when that happens.

Markets and order flow are dynamic. It is constantly moving, but out of this seemingly disorder, order arises. When it does it can be clearly seen and acted upon. Remember, markets exist to facilitate trade between parties, in other words transfer risk from producers to users. There are times when one side wants to "facilitate" trade more than others. Basically, they need to transfer as much risk away from them as possible. There can be many reasons why traders buy or sell to transfer risk. The key is to see when it happens, because when this happens, it happens quickly and when it, does it stands out in the order flow. The Flowscalper was created to show you when that happens.

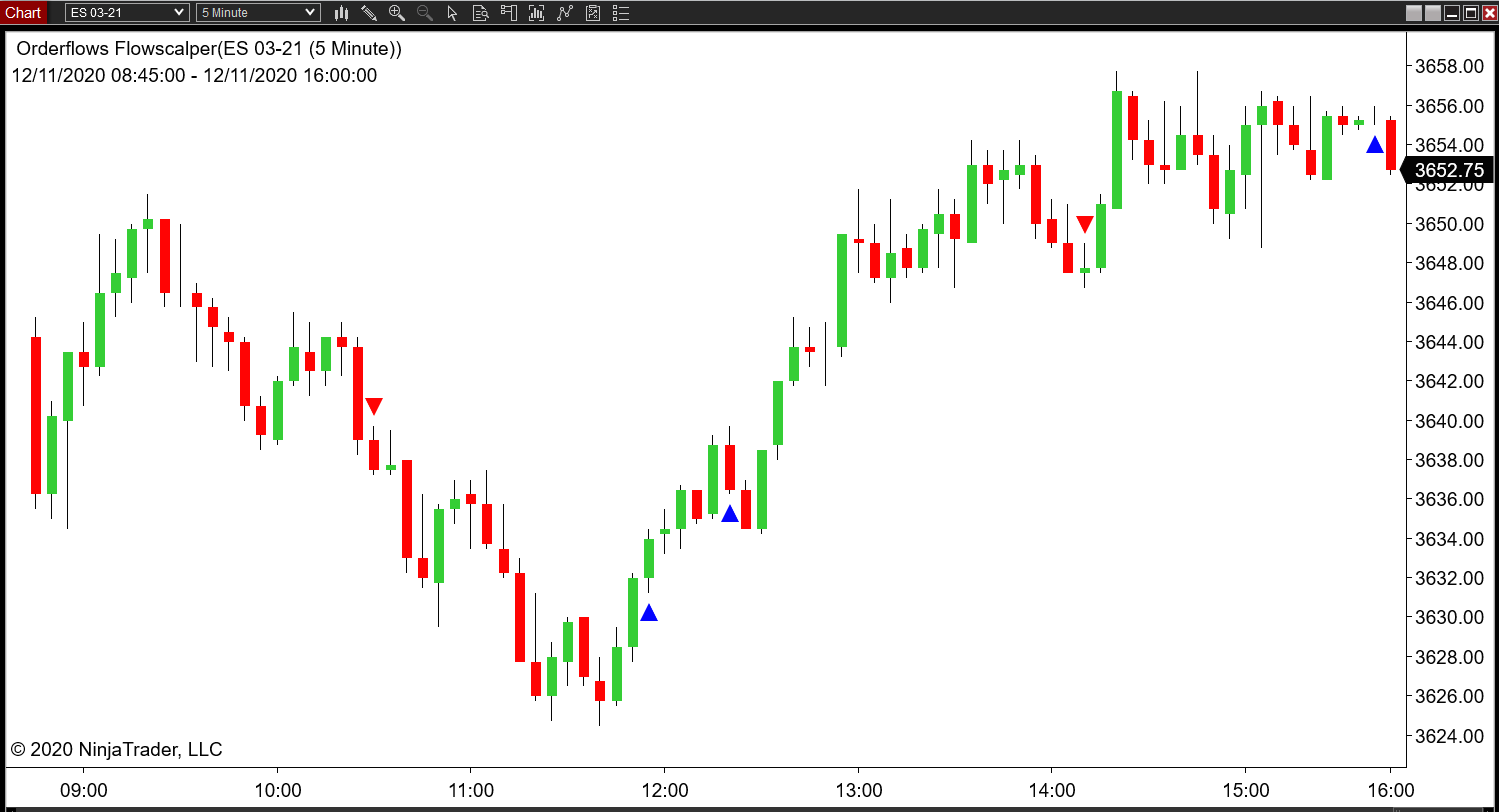

Very Flexible - See Just The Signals...

Draw Out Zones From The Signal Bar...

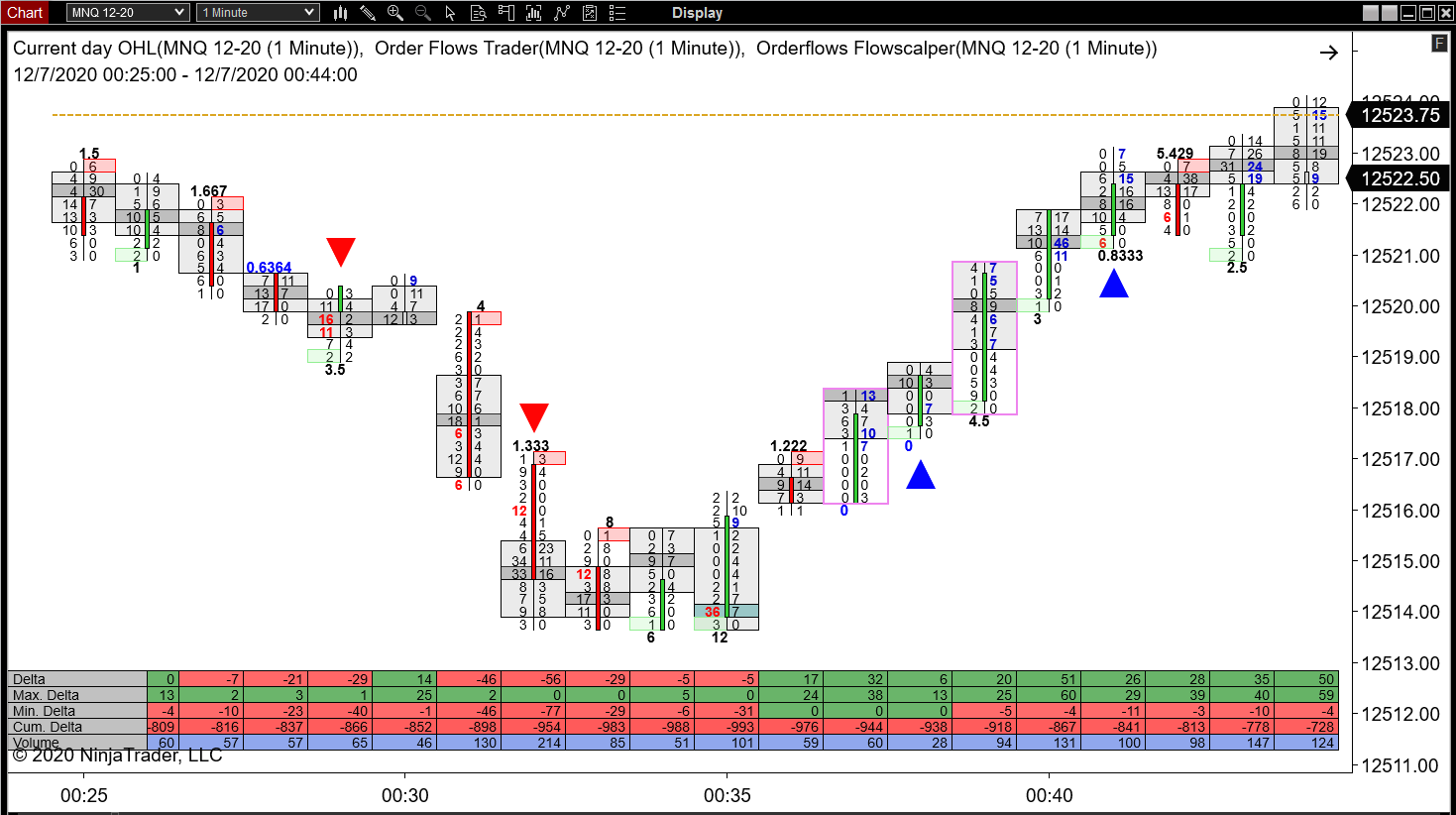

Even In The Micros...

Even In The Middle Of The Night...

To Make Order Flow More Accessible To Traders, We Have Programmed The Orderflows Flowscalper To Run On Normal Candlestick Charts As Well As Order Flow Footprint Charts!

Now You Get The Best Of Both Worlds - Powerful Order Flow Analysis & You Get To Use Your Favorite Existing Charts!

- Analyze Key Order Flow Data - Delta, Imbalances, POC & Volume.

- Combine Orderflows Flowscalper With Your Existing Form Of Market Analysis.

- Know What Is Happening In The Order Flow Without Learning Order Flow.

- Use Flowscalper With Your Existing Chart On NinjaTrader 8.

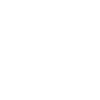

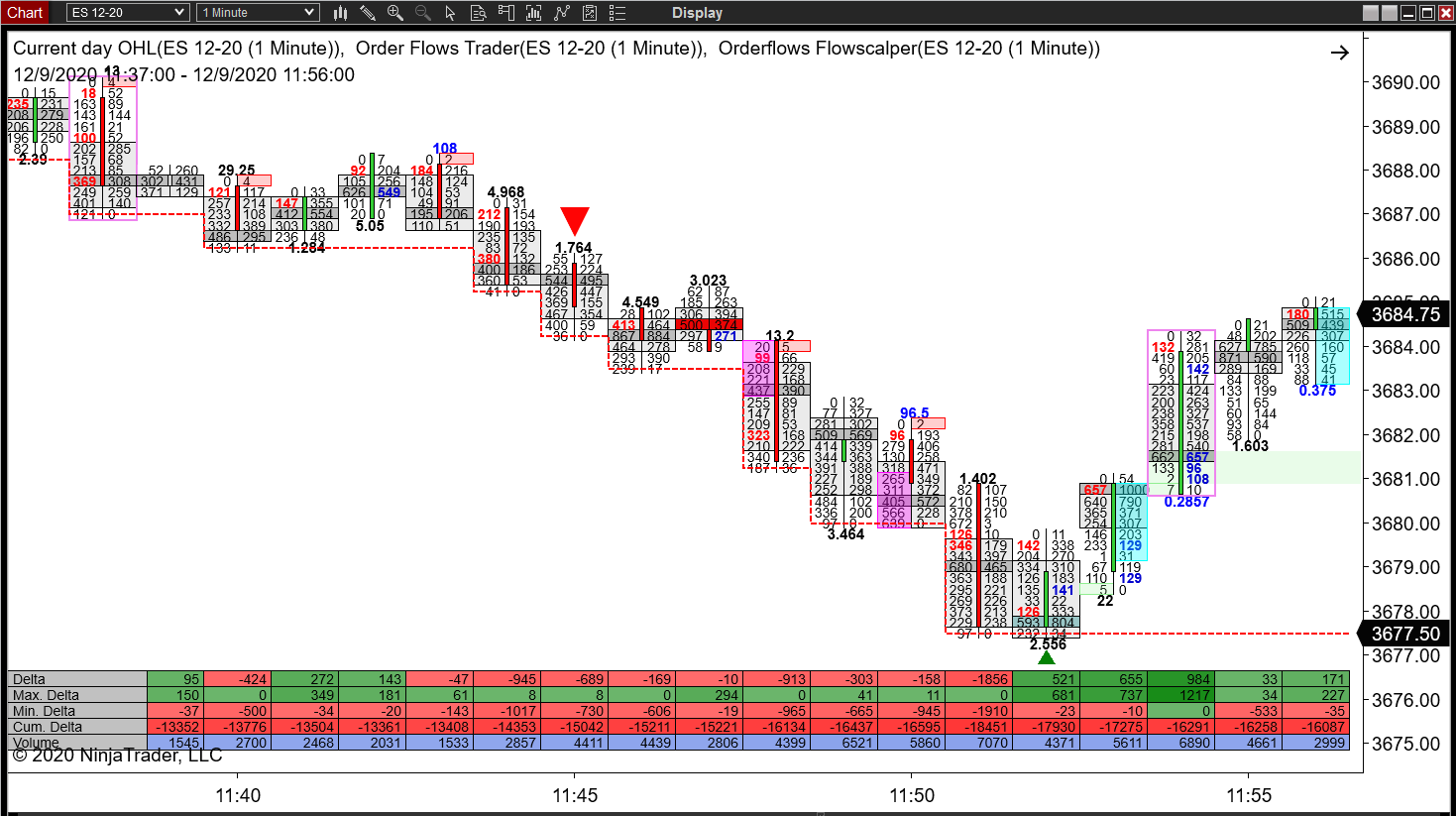

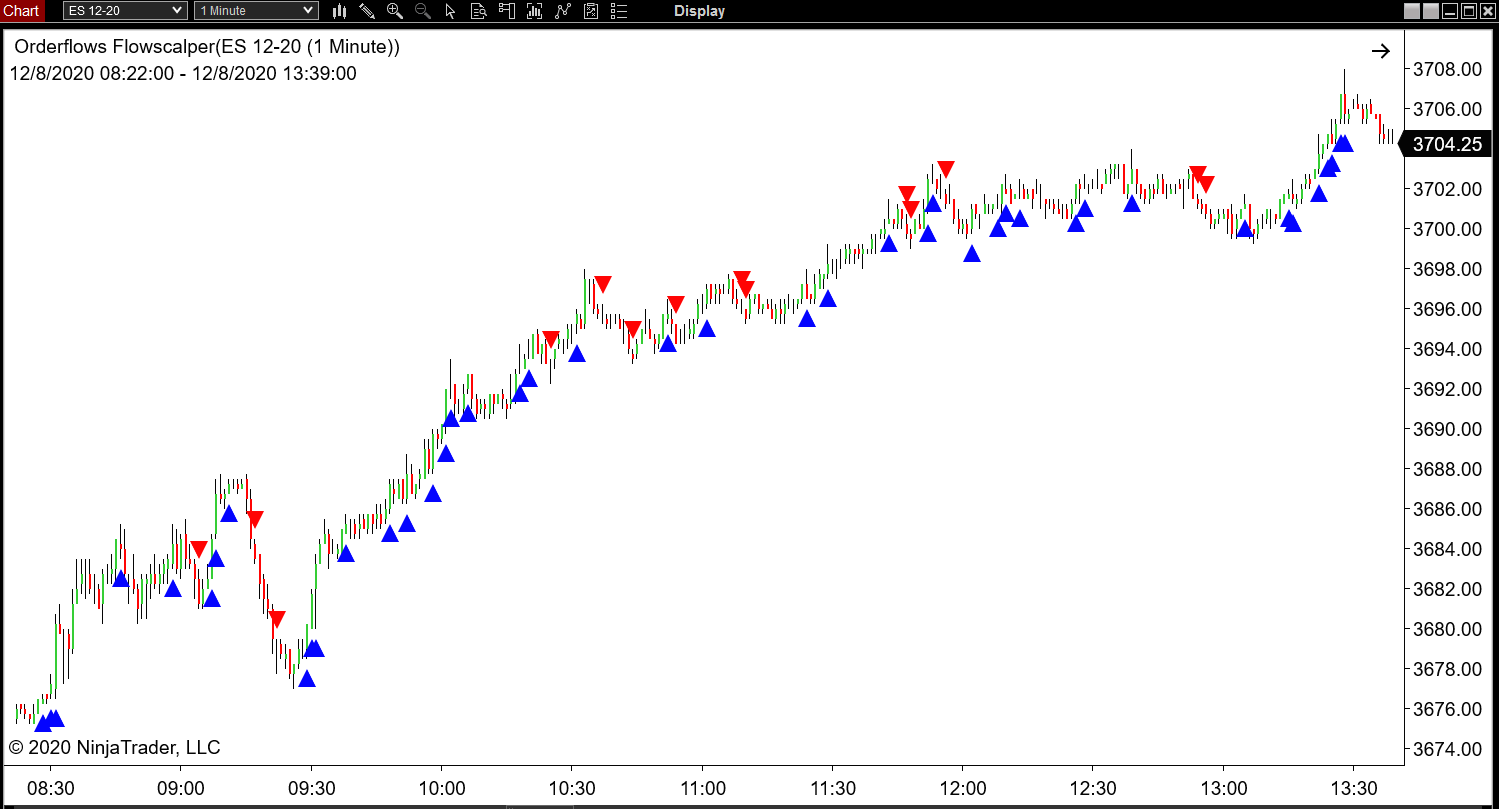

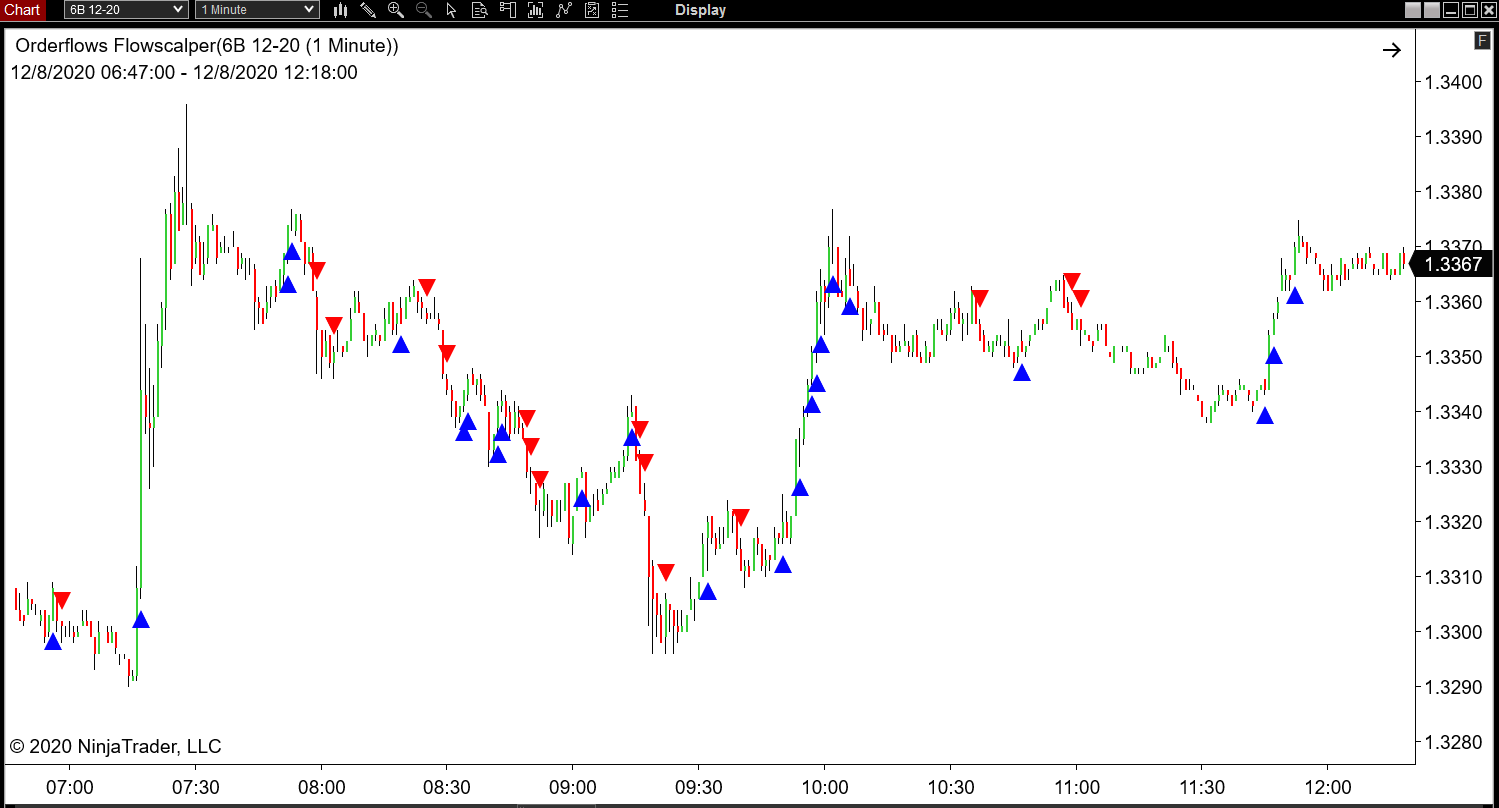

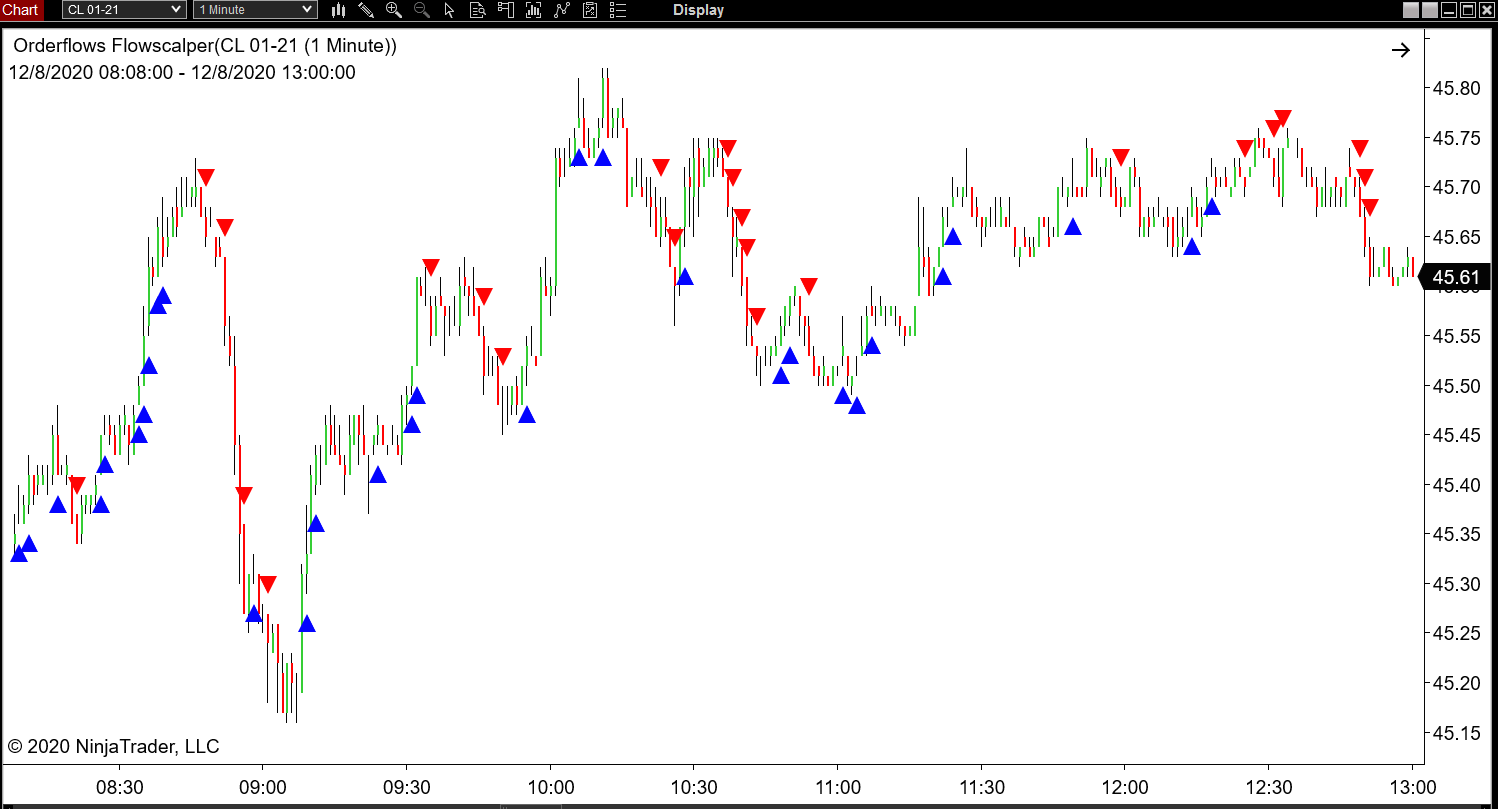

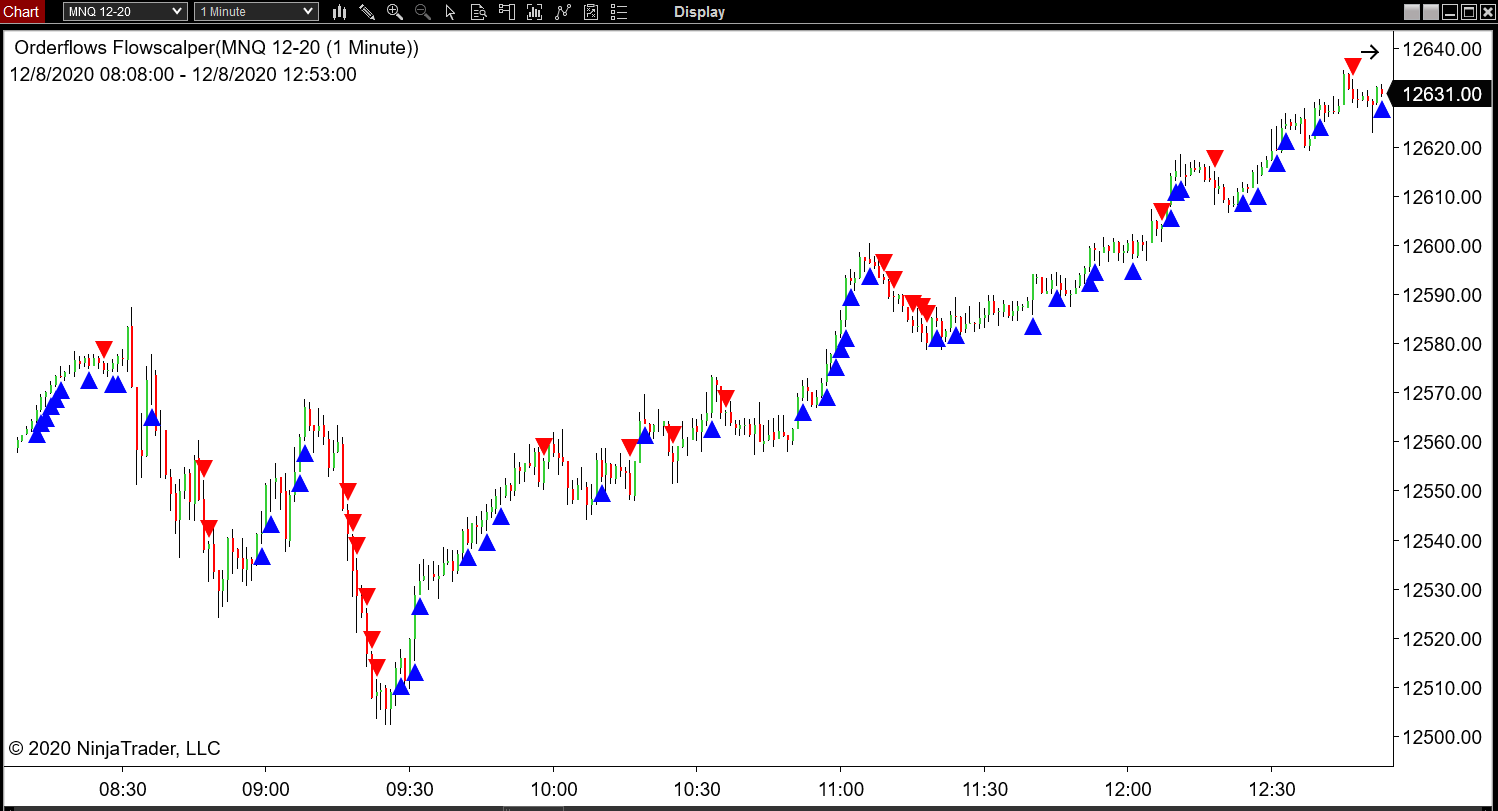

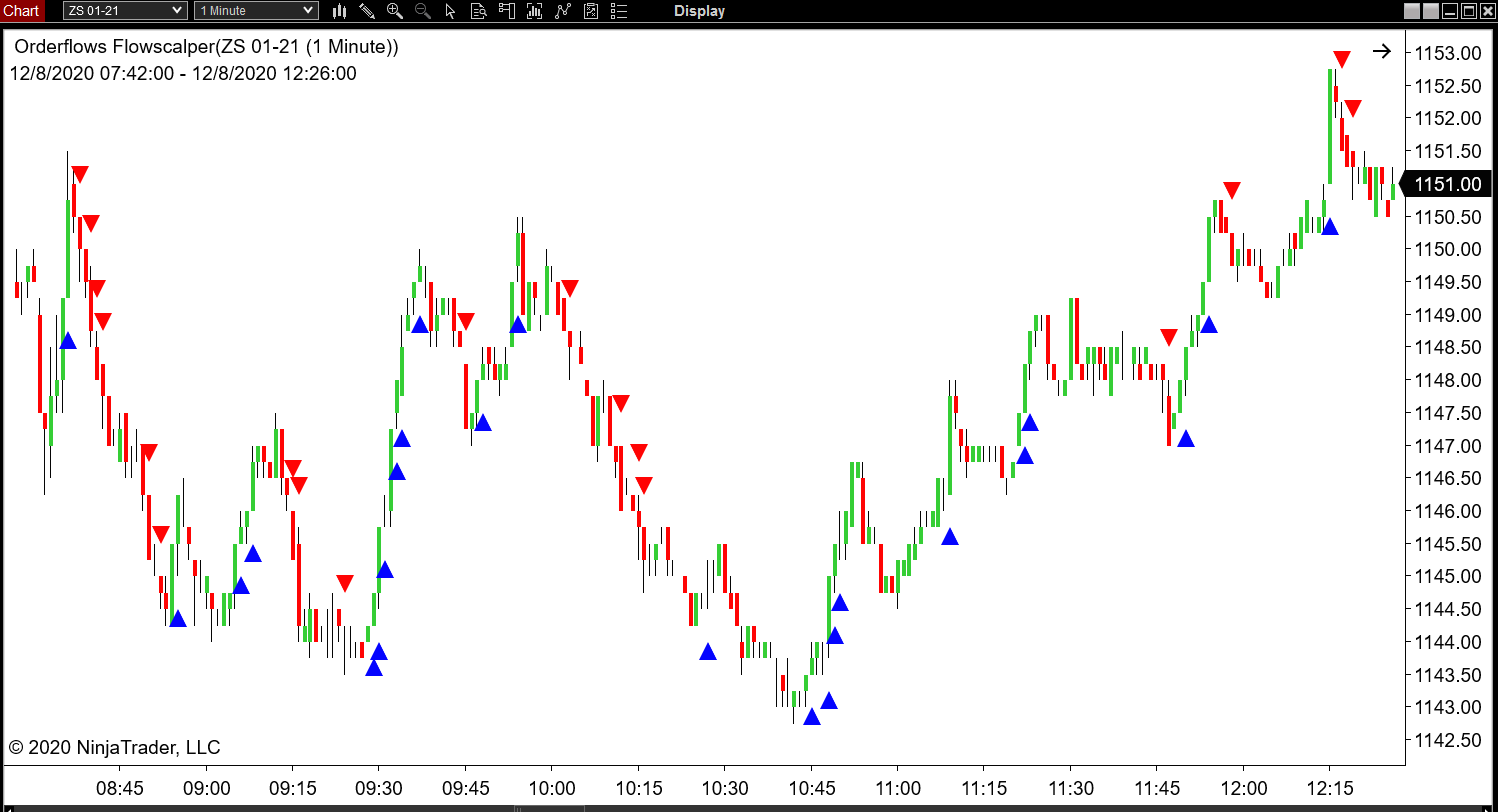

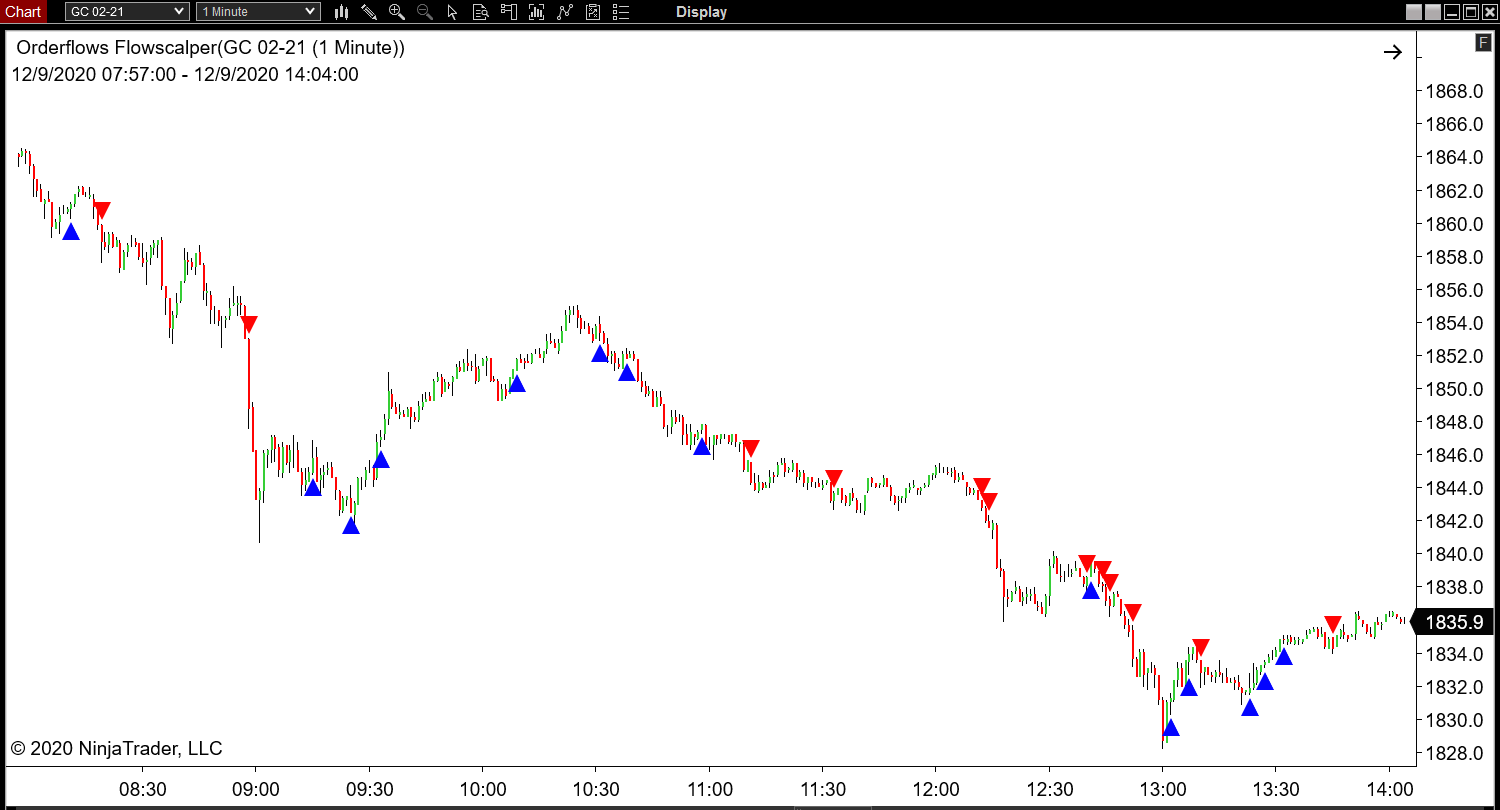

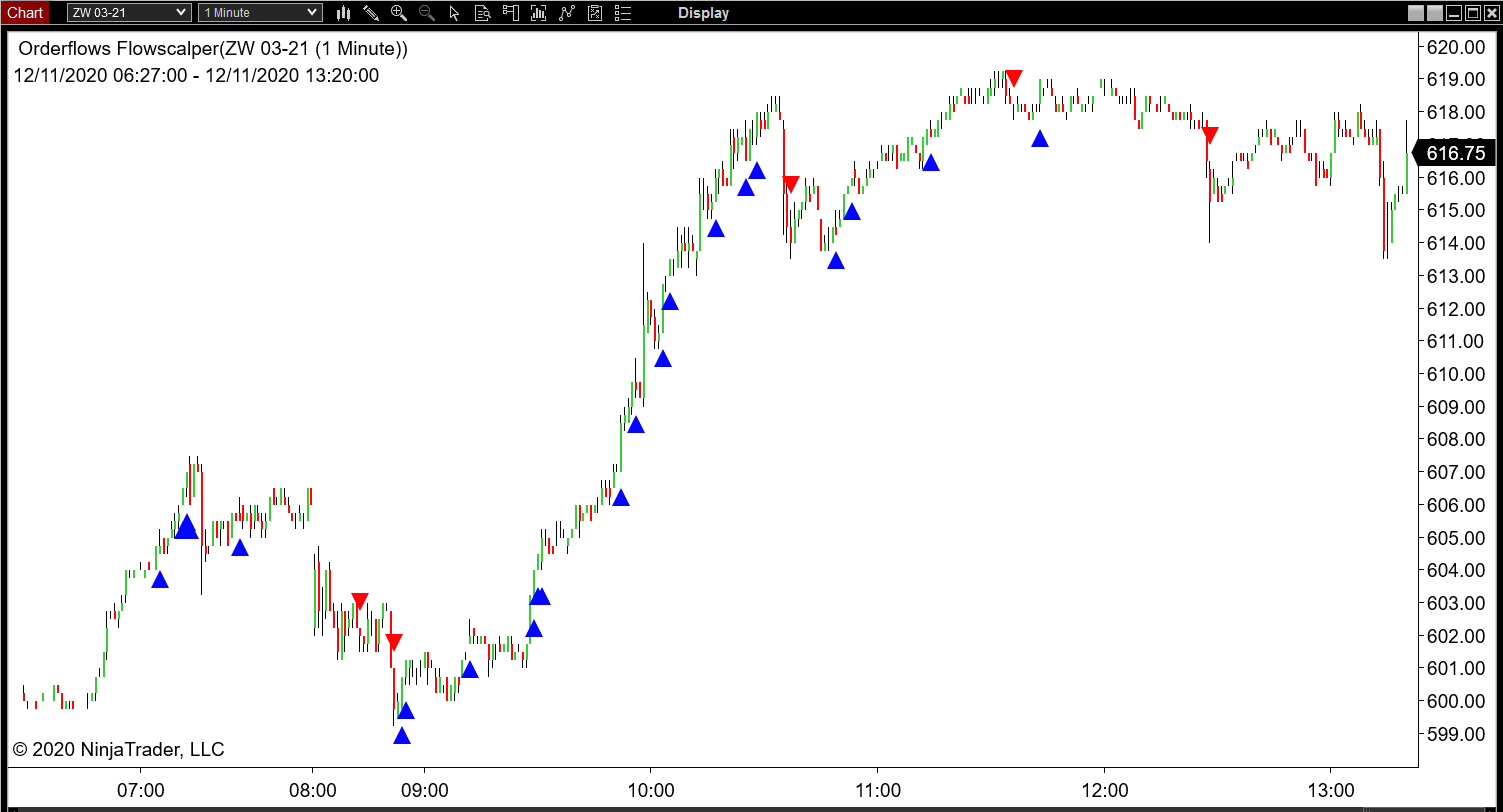

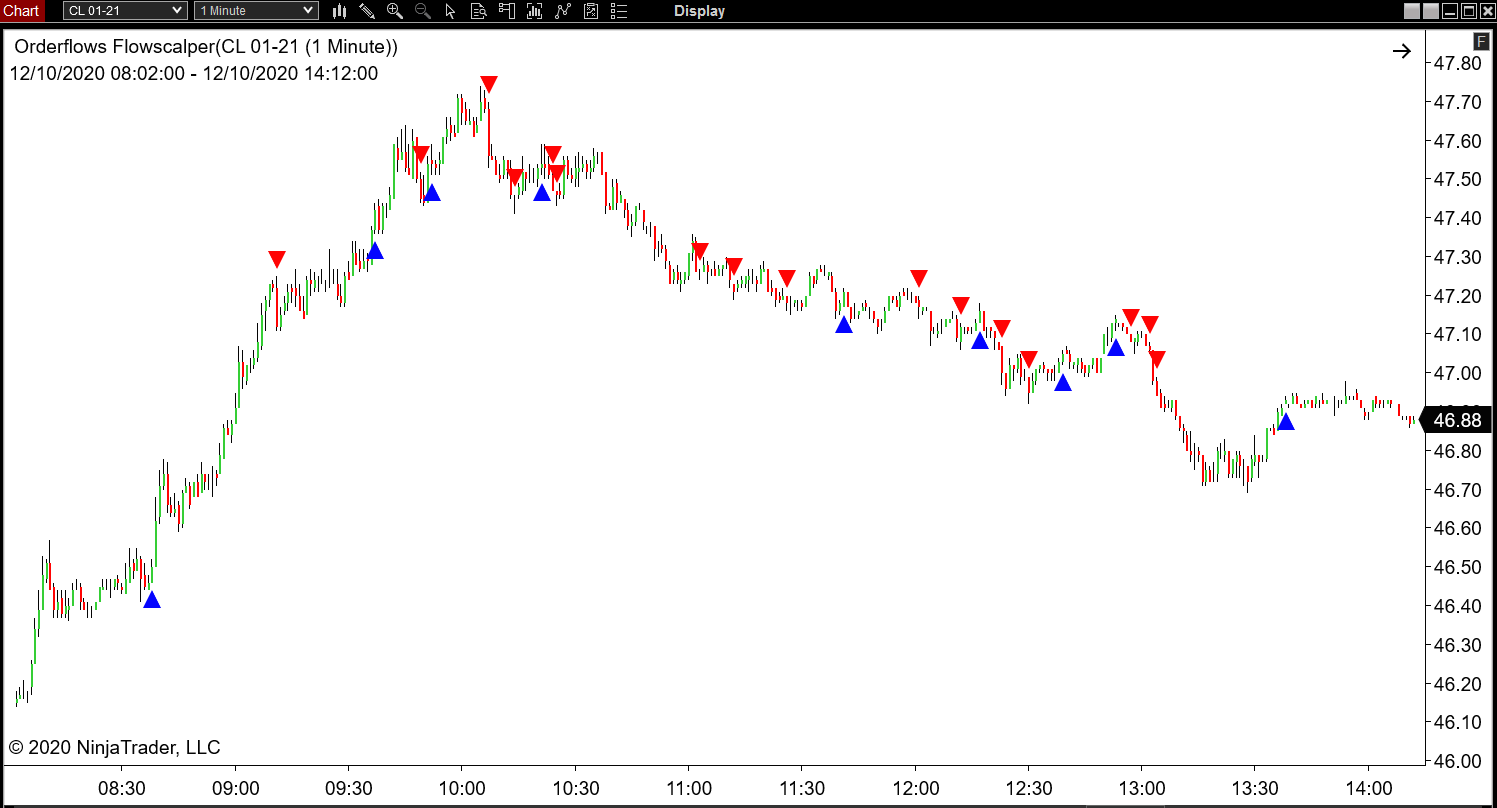

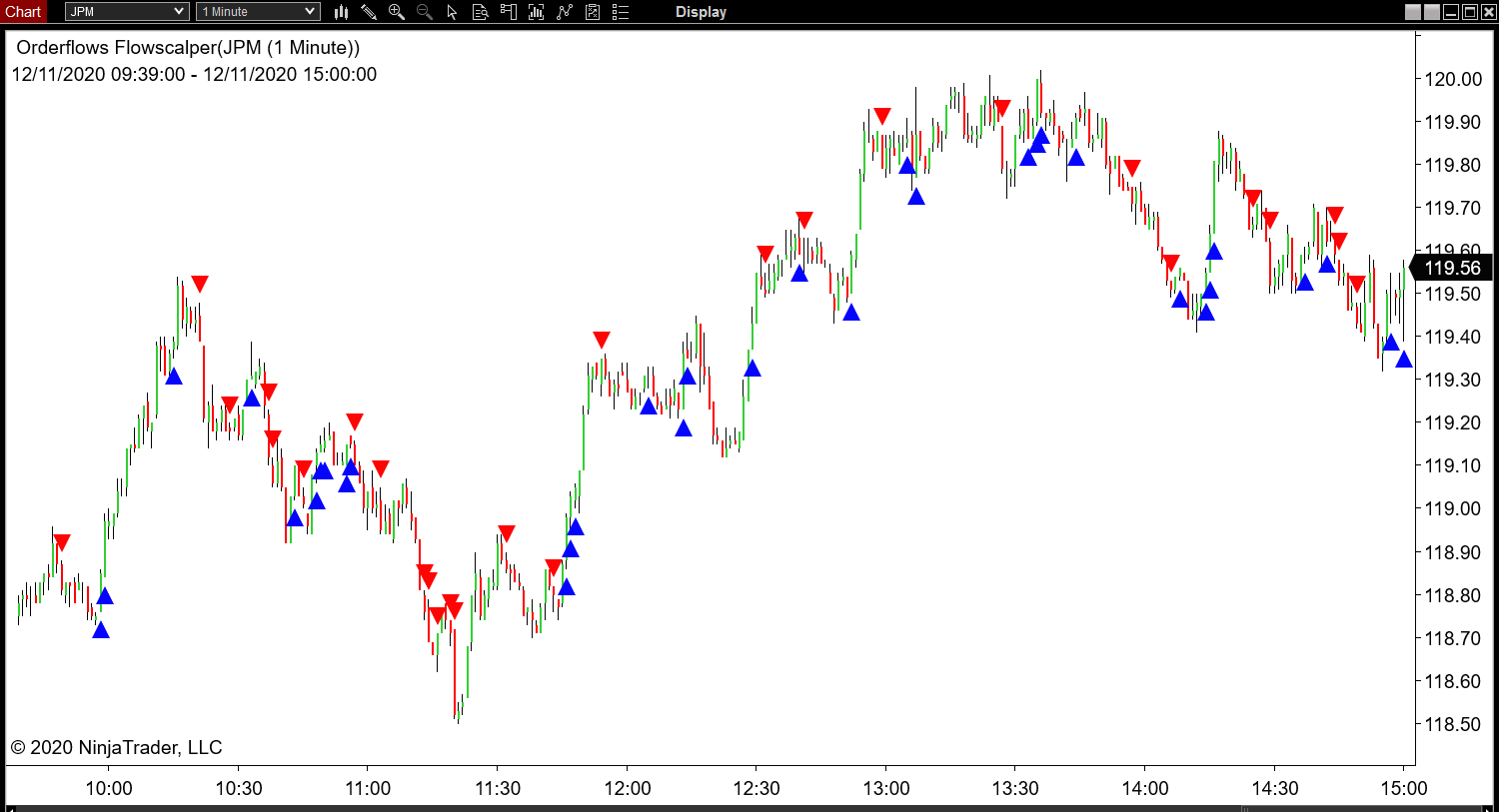

Check Out Flowscalper On Different Markets!

Here are 5 DIFFERENT markets, ALL 1-minute charts, ALL using the SAME settings.

Forget trying to figure out order flow, quite trying to make heads or tails of the footprint chart. We have taken all the information generated by market run it through the footprint chart on the back end and interpret it also on the back end to highlight on a normal candlestick chart where there is bullish or bearish order flow.

The Orderflows Flowscalper can be used on 1-minute charts, 5-minute charts, range based chart, tick based charts, volume based charts. Trades can be held for a few seconds, in a true scalping sense, or held for longer as long as the trade continues in your direction.

The Orderflows Flowscalper can be used on 1-minute charts, 5-minute charts, range based chart, tick based charts, volume based charts. Trades can be held for a few seconds, in a true scalping sense, or held for longer as long as the trade continues in your direction.

Stop Wasting Time & Money Trying To Figure Out

How It All Works, And Start Succeeding Now!

How It All Works, And Start Succeeding Now!

Don't let the name fool you. While the Orderflows Flowscalper was created for scalpers trading on a DOM who look for the next few ticks, the Flowscalper works great on minute based charts, range based charts, volume based charts and tick based charts.

If you are a day trader, adding Flowscalper to your trading toolkit will only make you a better trader by following the order flow.

If you are a day trader, adding Flowscalper to your trading toolkit will only make you a better trader by following the order flow.

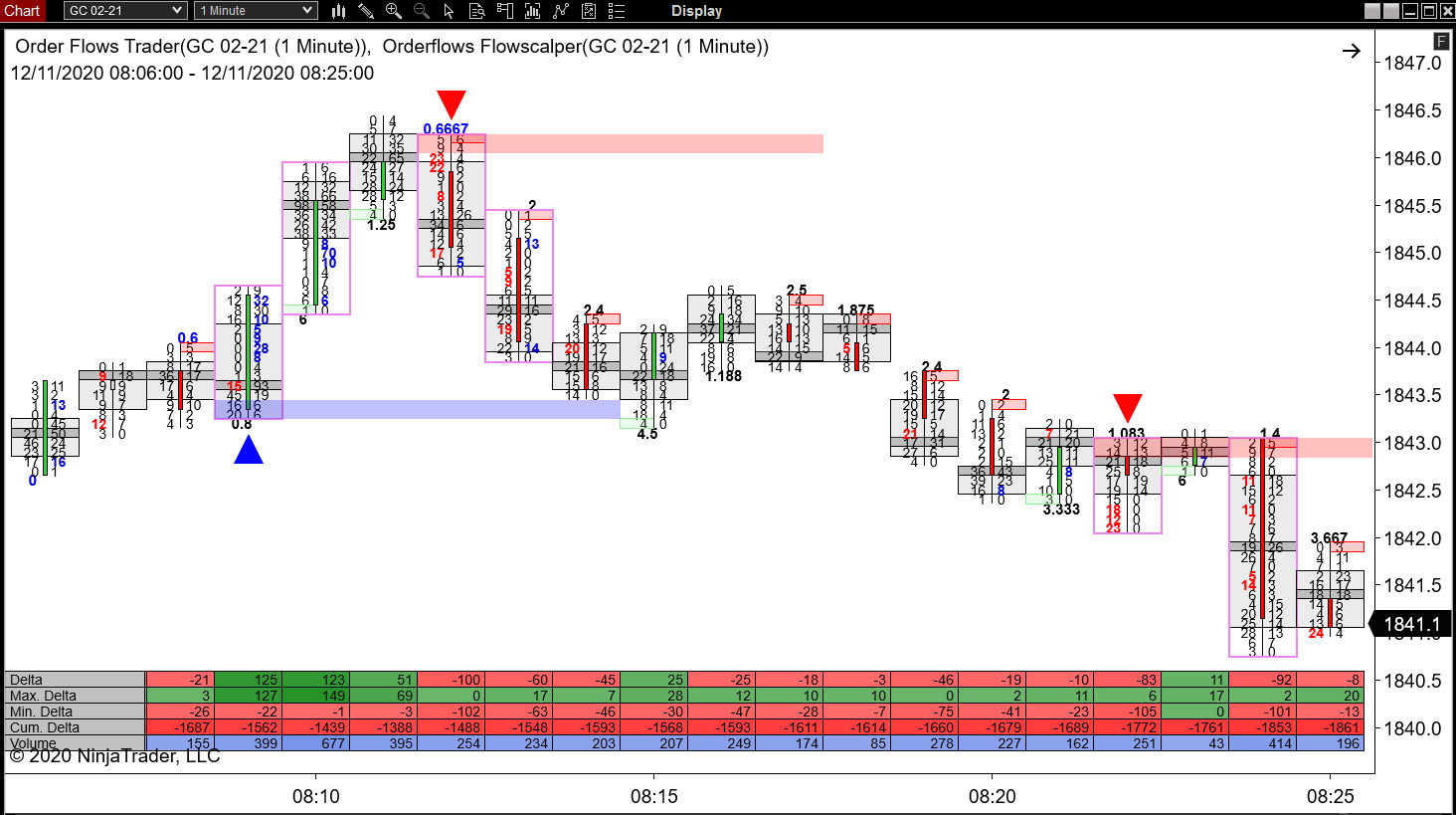

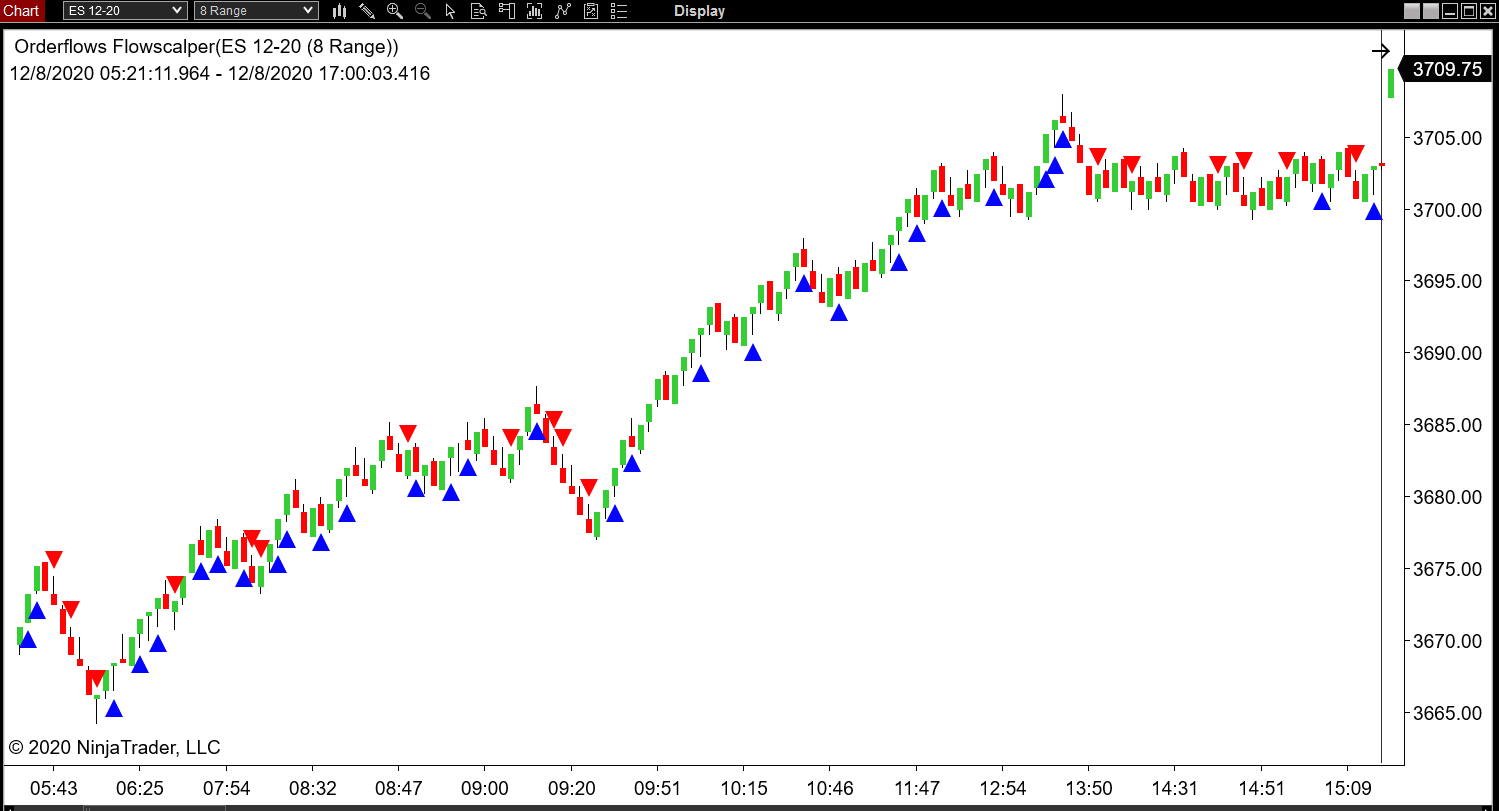

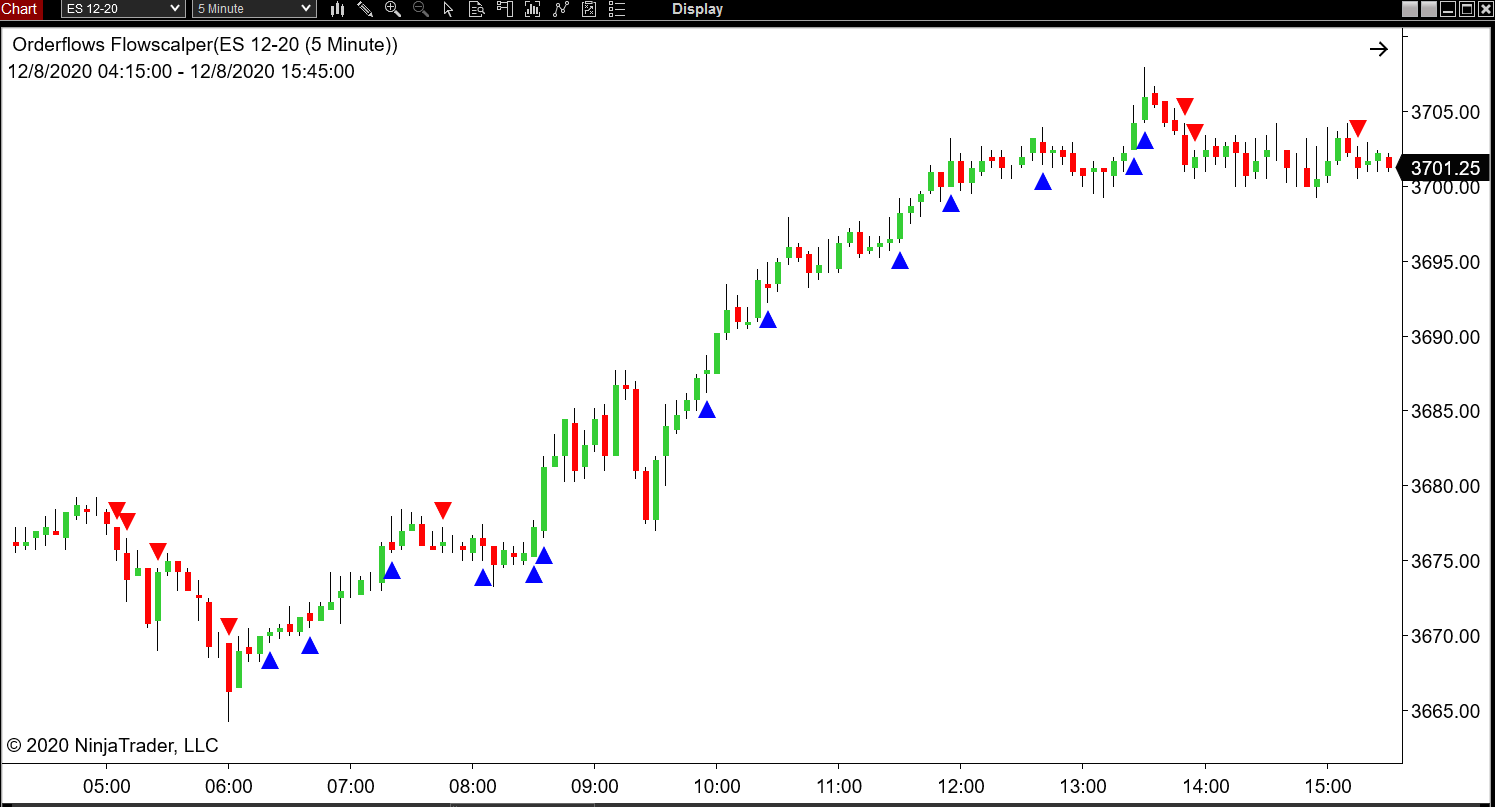

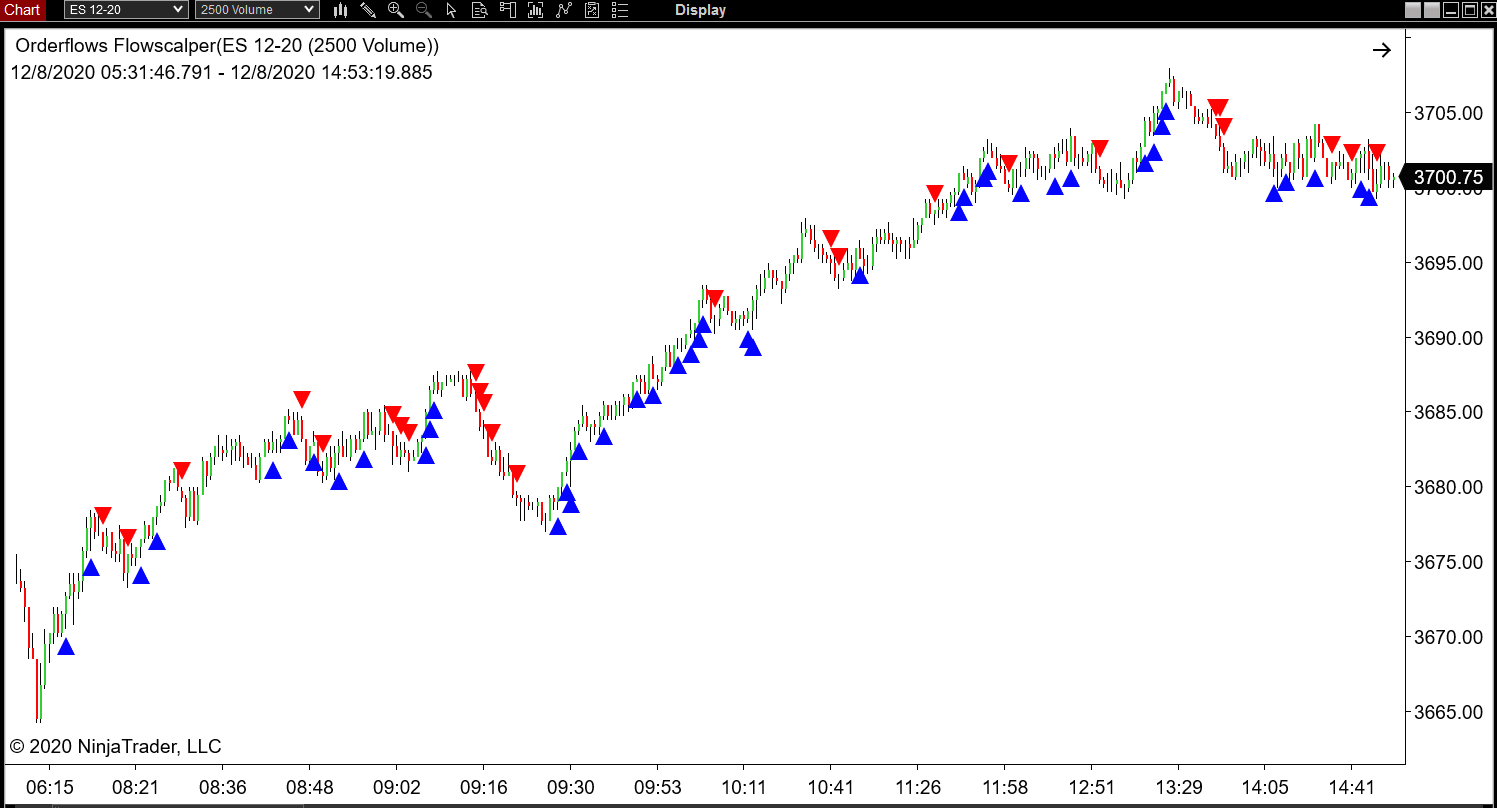

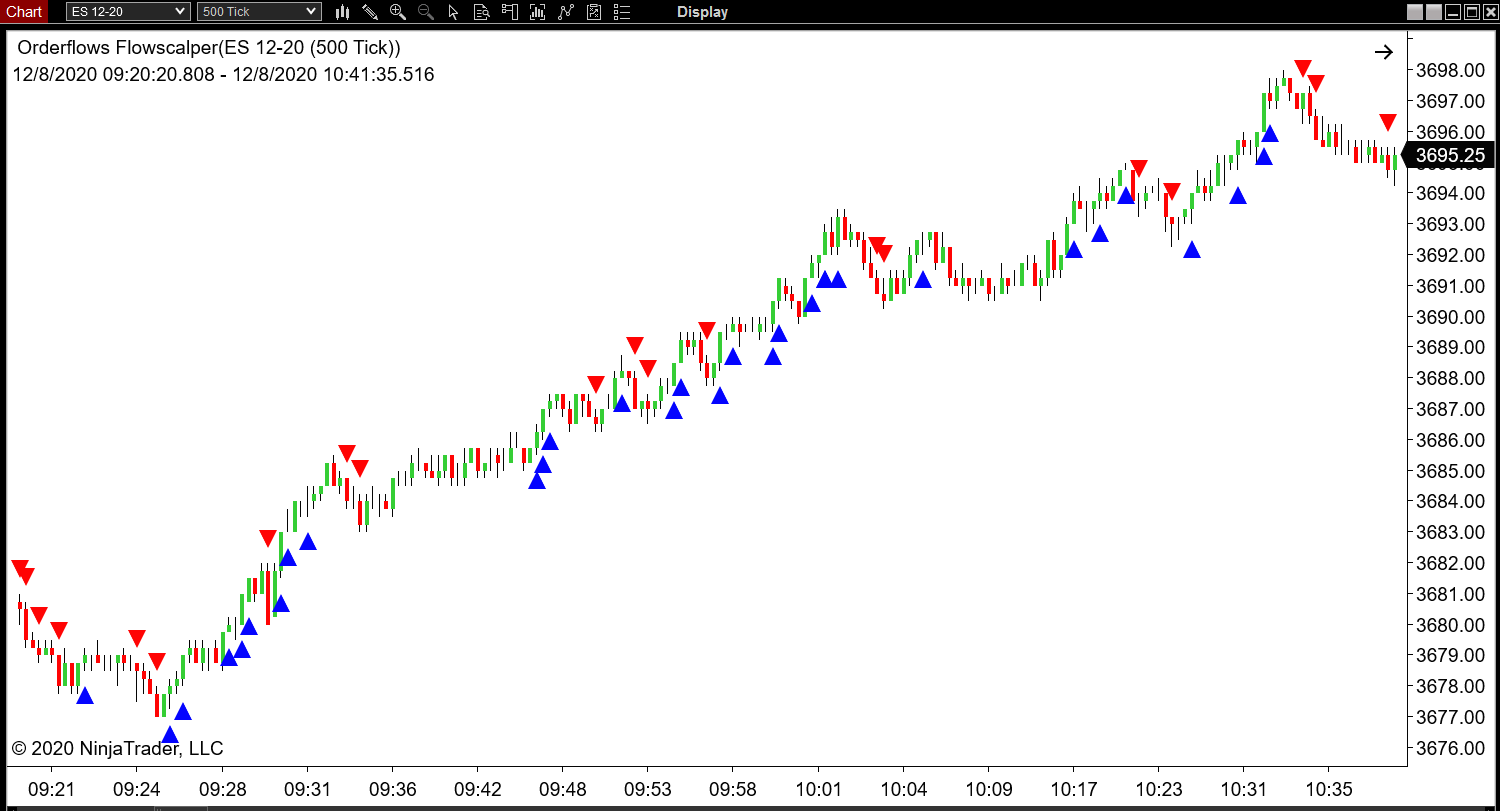

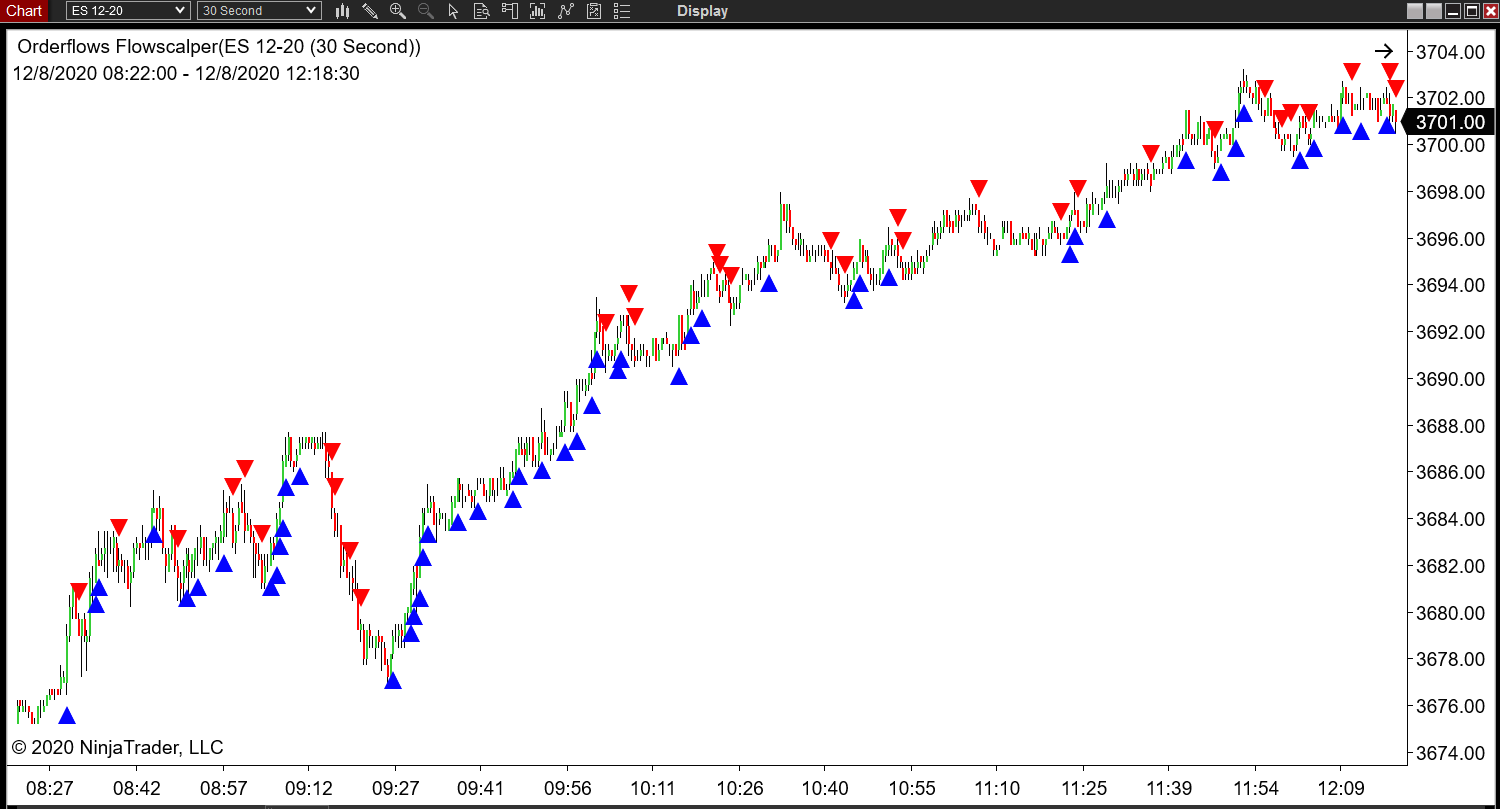

Check Out Flowscalper On The Same Market With Different Chart Types!

Here is e-mini SP 8-Range, 5-Minute, 500-Tick, 2500 Volume & 30-Second Charts.

These charts all have the same settings. I don't expect you to watch all theses different chart types, rather I want to show you how powerful the Flowscalper is. These charts all have the same settings. Different charts and time frames have different characteristics, if the signals are this strong on a default level, imagine how powerful they are when you take into account volatility and start adjusting them accordingly.

FREQUENTLY ASKED QUESTIONS

Q. Is the Flowscalper a footprint chart?

A. No. The Flowscalper is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowscalper?

A. No, the Flowscalper will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowscalper work on?

A. The Flowscalper is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowscalper will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowscalper available for Sierra Chart?

A. No. At the moment the Flowscalper is only available for NT8.

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowscalper works under different conditions.

Q. Does the Flowscalper work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowscalper to analyze FX markets?

A. Not really. Forex data is not centralized so analyzing order flow from various sources is not an ideal situation. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowscalper?

A. Futures and stocks work best with the Flowscalper.

Q. What time frame is best for Flowscalper?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowscalper performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

Q. Is there a sound alert?

A. Yes, there is a default sound alert that you can change to your own custom .wav file.

A. No. The Flowscalper is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowscalper?

A. No, the Flowscalper will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowscalper work on?

A. The Flowscalper is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowscalper will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowscalper available for Sierra Chart?

A. No. At the moment the Flowscalper is only available for NT8.

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowscalper works under different conditions.

Q. Does the Flowscalper work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowscalper to analyze FX markets?

A. Not really. Forex data is not centralized so analyzing order flow from various sources is not an ideal situation. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowscalper?

A. Futures and stocks work best with the Flowscalper.

Q. What time frame is best for Flowscalper?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowscalper performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

Q. Is there a sound alert?

A. Yes, there is a default sound alert that you can change to your own custom .wav file.

Get Flowscalper now for $597 regular price

$397 sale price

$397 sale price

Clicking on the order link will redirect you to our secure payment processor page on PayPal.

Please allow 3 to 6 hours for us to process your order. We will email you all the necessary files as soon as your order is processed.

Please allow 3 to 6 hours for us to process your order. We will email you all the necessary files as soon as your order is processed.

More Charts - GC 1-Minute

Wheat 1-Minute

CL 1-Minute

JPM Stock - 1 Minute

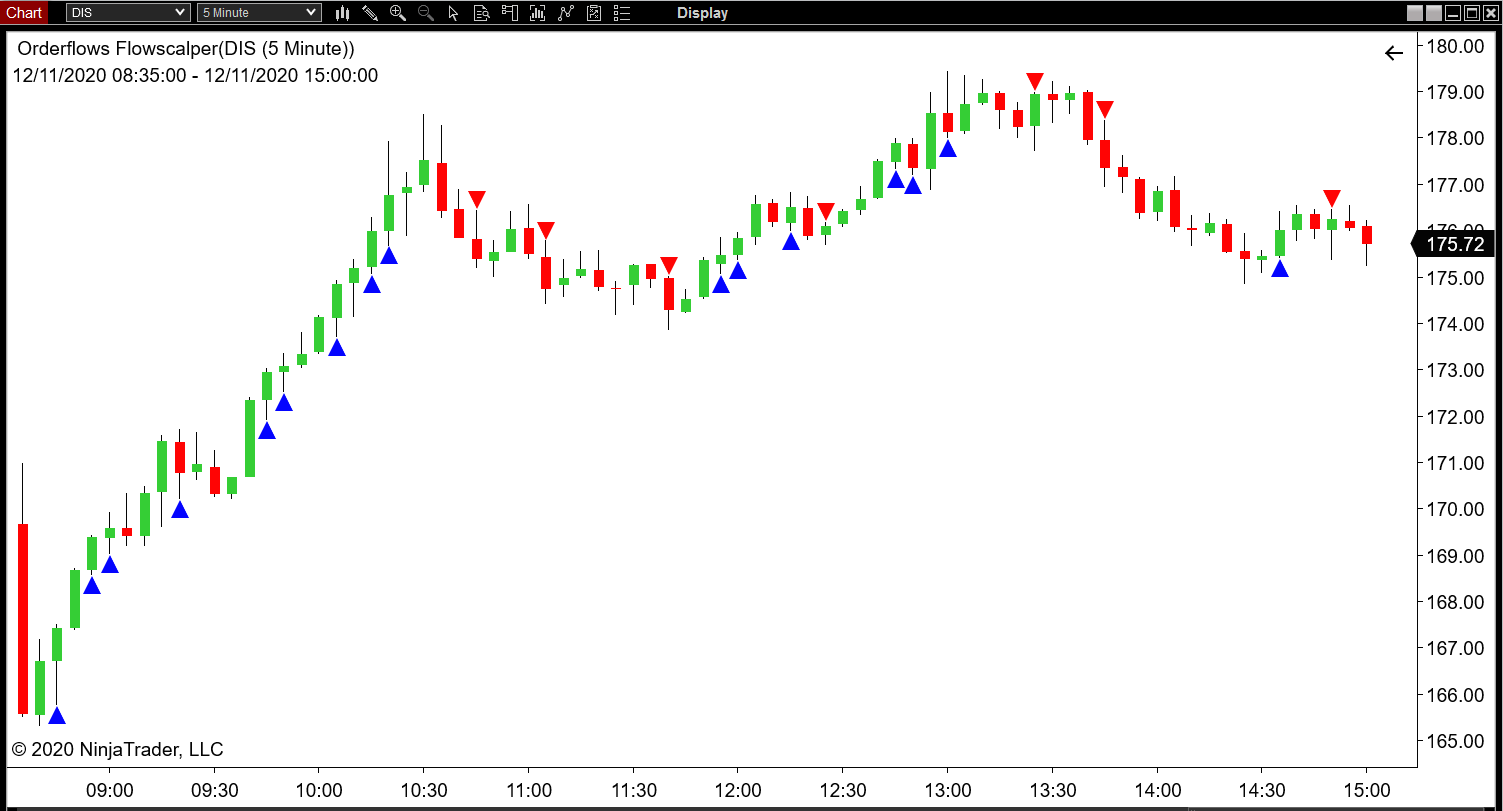

Disney Stock 1-Minute

Disney Stock 5-Minute

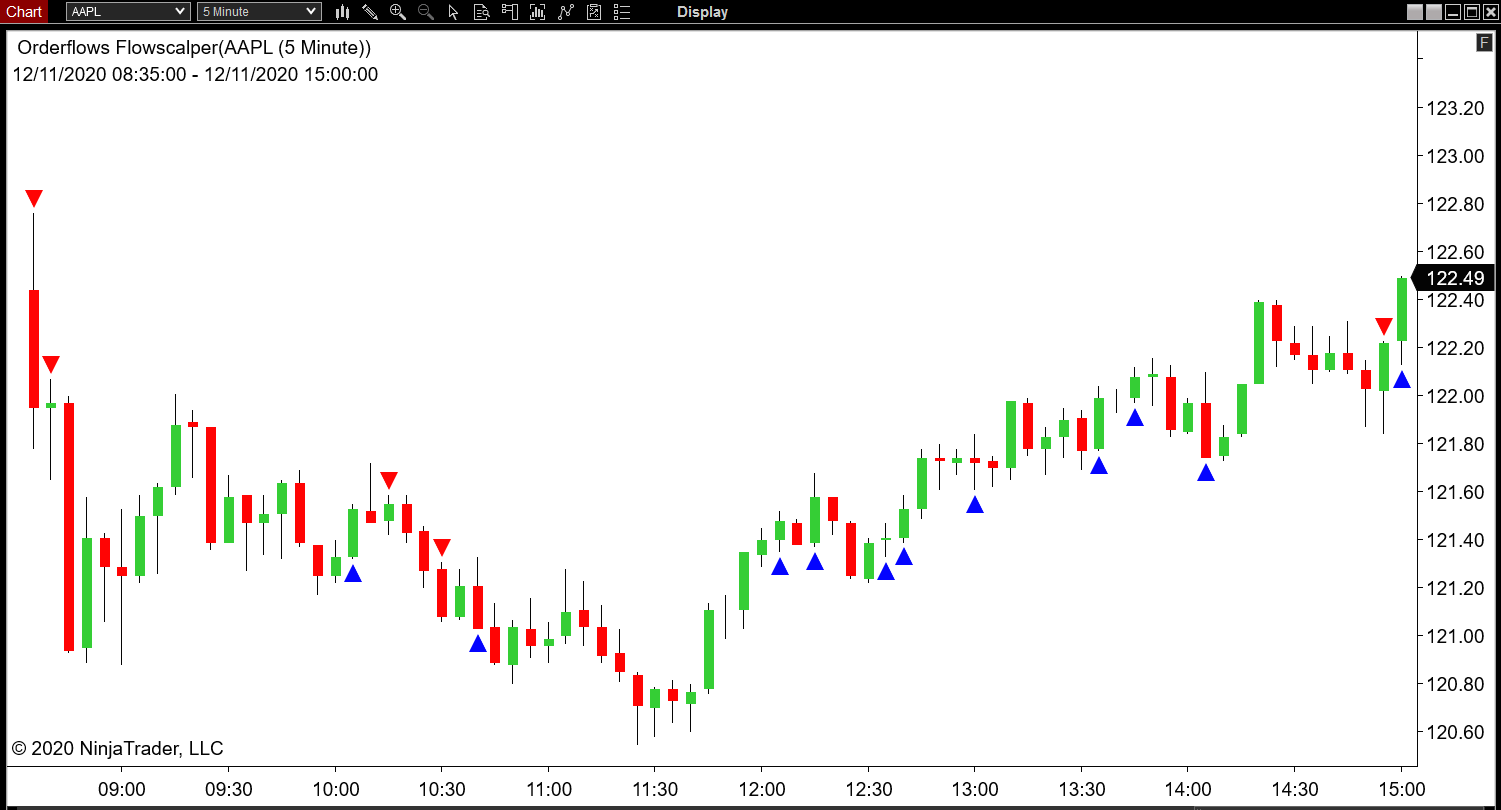

AAPL Stock - 5 Minute

As you can see, no matter what market you trade, Flowscalper is a very potent tool to add to your market analysis. It gives you an edge over trader who are not using order flow in their analysis. Flowscalper will get you as close to the market as possible, picking up market turning points as well as when momentum starts to get strong directionally.

All Rights Reserved - Orderflows.com & Flowscalper.com - Copyright 2020

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..